Find affordable health insurance in Utah that is available for individuals, families, and small and large businesses. Instantly compare comprehensive and catastrophic policies that fit within your budget. Exchanges and Marketplaces allow you to directly purchase quality medical coverage from the most reputable carriers. Our website makes it easy to shop for the lowest 2024 prices, compare the best plans, and easily purchase enroll for coverage in less than 25 minutes. Any changes resulting from changes to Obamacare will be immediately published on our website.

Applicants that have reached age 65 and are Medicare-eligible, can apply for Medigap coverage. Many plans are offered that can reduce out-of-pocket costs, such as copays, coinsurance, and deductibles. Advantage and Supplement policies are "guarantee-issue" during the separate Open Enrollment period of October 15th-December 7th. Also, when you first become eligible for Medicare, a 7-month window is provided to compare and choose Medigap benefits. Part D prescription drug plans are also offered.

NOTE: The Under age-65 Marketplace OE period occurs between November 1 and January 15th (additional details below). It is possible for one spouse to be covered under an individual Marketplace plan, while the other spouse has reached age 65 and has supplementary benefits. Children and dependents can also be covered under separate plans, although the total cost may be higher.

The Utah Health Exchange is federally managed, and we help you find the best fit for you or your family. You can customize benefits to match your individual situation. Whether you are in perfect physical and mental condition, or have multiple per-existing conditions that require chronic treatment, we review the policies that are the most cost-effective. regardless if you live in Salt Lake City, Provo, Orem, Sandy, Ogden, or any other part of the state, you are eligible to enroll (assuming you meet application qualifications). The seven carriers offering Marketplace plans are Regence BCBS, Cigna, BridgeSpan, Molina, SelectHealth, Aetna, and University Of Utah.

Cigna and BridgeSpan were new participating carriers three years ago. BridgeSpan previously marketed on-Exchange plans seven years ago, and will offer coverage in Davis and Weber counties. Bronze-tier plans are now available from Molina, which feature lower premiums, but higher out-of-pocket costs. Regence BCBS now offers on-Exchange plans after offering only off-Exchange plans two years ago year.

2024 Utah Marketplace Plan Rate Change Requests

BridgeSpan HMO No Chiro/Ped Dental -- 6.74% decrease

Cigna UT_IND_EPO -- 0.01% increase

Molina Individual -- 5.58% decrease

Molina Individual + Vision -- 6.07% decrease

Regence BCBS Direct EPO -- 7.94% increase

Regence BCBS EPO No Chiro/Ped Dental -- 10.80% increase

SelectHealth Select Med -- 15.53% increase

SelectHealth Value No Ped -- 9.62% increase

University Of Utah Health Insurance Plans Healthy Premier EPO -- 8.50% increase

University Of Utah Health Insurance Plans Healthy Premier Prosthetics -- 17.30% increase

What Are The Types Of Available Plans?

When the "Affordable Care Act" was enacted, four types of "Metal" policy options were created for consumers. They are "Platinum," "Gold," "Silver," and "Bronze." The Platinum contracts are the most expensive, since they pay approximately 90% of your medical expenses. The Bronze contract costs the least of the Metal options, since up to 40% of projected medical costs have to be paid by you. Of course, the overall health of your household ultimately determines how much out-of-pocket cost you pay. Bronze and Silver-tier plans are the most popular.

An additional type of policy that is offered is a "Catastrophic" contract. Available to persons under age 30, or anyone that can't afford other Metal plans, rates are very inexpensive, since deductibles and out-of-pocket expenses are higher. The cheapest available catastrophic plans are Bright Health Catastrophic 8700, SelectHealth Value Catastrophic 8700, and Select Health Med Catastrophic 8700. Federal subsidies do not apply, so often, rates on these plans may actually be higher than Bronze-tier options.

Bronze-Tier Options Vs. Catastrophic Options

However, if you are over the age of 30, to qualify for these low-cost plans, there must be no other available options that cost less than 8% of your income. It is also important to understand that catastrophic contracts are not eligible for the federal subsidy. Thus, in many situations, a Bronze or Silver plan may only cost less because of the instant tax-credit. And special "cost-sharing" features on Silver plans often reduce the deductible by thousands of dollars. Just as importantly, there is no limit on the number of covered primary-care physician (pcp) or specialist office visits you can use (subject to an applicable copay) on Bronze-tier plans.

Sample Rates For Young Persons

How cheap are premiums on these plans? Below, we have provided several examples for a 30 year-old ($36,000 income) that resides in Salt Lake County. Because of the federal subsidy, many low-cost options are offered. Prices shown are monthly. Several plans have a $0 premium since federal subsidy exceeds cost of policy.

$0 -- Aetna Bronze 2 HSA

$0 -- Regence BCBS Bronze 8500 Deductible

$0 -- University Of Utah Health Plans Bronze

$2 -- University Of Utah Health Plans Expanded Bronze Standard

$7 -- Aetna Bronze 4

$7 -- Regence BCBS SaveWell Bronze 7500 Deductible

$8 -- Regence BCBS Bronze Essential 8500 Deductible With 4 Copay No Deductible Office Visits

$8 -- Aetna Bronze S

$10 -- Select Health Value Expanded Bronze 6900 Medical Deductible

$13 -- Regence BCBS SaveWell Standard Bronze 7500 Deductible

Sample Family Monthly Rates

Family Of Five (50 year-old husband and wife with three children) residing in Provo. $117,000 Household income.

$50 -- Aetna Bronze 2 HSA

$94 -- Regence BCBS Bronze 8500 Deductible With 4 Copay No Deductible Office Visits

$161 -- Regence BCBS Bronze 7500 Deductible

$187 -- BridgeSpan Standard Bronze Plan

$202 -- Regence BCBS Bronze HSA 7000 Deductible

$218 -- Imperial Standard Bronze

$218 -- Select Health Value Expanded Bronze 6900 Medical Deductible

$247 -- Aetna Bronze 4

$253 -- Aetna Bronze S

$278 -- Select Health Value Benchmark Expanded Bronze Copay Plan

Family Of Four (40 year-old husband and wife with two children) residing in Salt Lake City. $88,000 Household income.

$9 -- Aetna Bronze 2 HSA

$107 -- Regence BCBS Bronze 8500 Deductible

$113 -- University Of Utah Health Plans Bronze

$122 -- University Of Utah Health Plans Expanded Bronze Standard

$137 -- Aetna Bronze 4

$137 -- Regence BCBS SaveWell Bronze 7500 Deductible

$140 -- Regence BCBS Bronze Essential 8500 Deductible With 4 Copay No Deductible Office Visits

$141 -- Aetna Bronze S

$148 -- Select Health Value Expanded Bronze 6900 Medical Deductible

$158 -- Regence BCBS SaveWell Standard Bronze 7500 Deductible

Required Benefits

"Essential Health Benefits" are included on all policies. They consist of a wide variety of items including complete preventive care for adults and children, catastrophic hospital, office visit, prescription, maternity, mental health and many other coverages. Unlike policies prior to 2014, these plans have very few or no gaps. Although alternative plans are available without these benefits (short-term contracts), federal subsidies are not offered, pre-existing conditions are not guaranteed to be covered, and since temporary contracts are underwritten policies, applications can be denied.

If any plans do not contain these 10 mandated benefits, including temporary contracts previously mentioned, they can not be approved for enrollment through any Exchange in the US. Also, a 2.5% household income tax penalty is no longer assessed if a non-compliant policy is purchased instead of an approved plan. A 3-month grace period was previously provided that helped offset some of the penalty. Thus, a household with $60,000 of income will not face a special tax of about $1,500 if they remain uninsured for an entire year.

Temporary policies are a very viable solution to situations that leave you very little time to obtain coverage. For example, if your existing benefits (non-compliant) were set to expire in 48 hours (and you were not eligible for COBRA or a "Special Enrollment), obtaining approved coverage quickly would become your immediate priority. Since a 2.5% income tax penalty can not be imposed, the lower premiums and major medical coverage provided from a short-term plan may be your best choice for that specific predicament. Office visits, urgent-care and prescription drug copays are often available.

About 70 different policies are offered through the Marketplace by all carriers. Several of the larger carriers, such as UnitedHealthcare and Humana are not participating in the subsidized Marketplace, although they offer "off-Exchange" options. Humana is the most recent carrier to cease writing "on-Exchange" business. SelectHealth offers plans in most counties in the state.

You can also buy policies independently from the Exchange (off-Exchange). Since these options don't pay a federal subsidy, your individual income should be at least $58,000 (Age 35) and your family income at least $180,000 (Family of four -- Adults age 35) before you consider these plans. It is possible that the number of available physicians, specialists and other facilities may be larger on policies bought "away from the Marketplace."

NOTE: The size and age of your family will impact the income guidelines just mentioned. Thus, the "breakpoint" income may be $98,000 for one family, and $115,000 for another.

Which Utah Health Insurance Companies Offer The Lowest Rates?

There may not be a good answer for that question since there are so many variables. Of course our website allows you to easily compare the best options when you provide your zip code. However, listed below are the four carriers that offer single and family coverage throughout the state. Note: Companies that previously stopped offering private individual medical coverage include: UnitedHealthcare, Arches Mutual, Humana, and Altius (Aetna/Coventry). Regence Blue Cross, now offers on-Exchange options. BridgeSpan is a popular carrier that offers coverage.

SelectHealth specializes in HMO-type of coverage along with high-deductible plans (HDHP) that work with HSA accounts. With their HMO coverage, a "primary-care physician" is selected that coordinates your treatment. For more than 25 years, SelectHealth has been providing integrated coverage, and they were voted Utah's "Top Plan" last year. J.D. Power Amp; Associates gives them a high ranking in member satisfaction (four consecutive years) and we expect this tradition to continue.

University Of Utah Health Plans began operating in 1998 and now insures almost 150,000 persons. In addition to single and family coverage, they also cover self-funded employer groups, along with Medicare and Medicaid recipients. As a local carrier, they are very community-oriented, and also offer many attractive student medical plans.

Molina is a Fortune 500 company that has conducted business in Utah for more than 30 years, and covers more than 5 million persons in the US.

Cigna has more than 170 million customers and patients, and is one of the nation's largest insurers. They offer group, dental, and many other ancillary products in Utah.

Most Affordable Health Insurance Plans In Utah

Catastrophic Tier

No plans available.

Bronze Tier

SelectHealth Signature Benchmark Bronze 9100 -- $9,100 deductible with maximum out-of-pocket expenses of $9,100 and 0% coinsurance.

SelectHealth Value Benchmark Bronze 8700 -- $9,100 deductible with maximum out-of-pocket expenses of $9,100 and 0% coinsurance.

SelectHealth Select Value Expanded Bronze 7500 HSA Qualified -- HSA-eligible plan with $7,500 deductible and $7,500 maximum out-of-pocket expenses and 0% coinsurance. 100% coverage after deductible has been met.

SelectHealth Signature Expanded Bronze 6900 -- $45 and $95 office visit copays. $6,900 deductible with maximum out-of-pocket expenses of $9,100 and 50% coinsurance. $20 and $30 Tier 1 and Tier 2 drug copays. $95 Urgent Care copay.

SelectHealth Value Expanded Bronze 6900 -- $6,900 deductible with maximum out-of-pocket expenses of $9,100 and 50% coinsurance. $45 and $95 office visit copays and $95 Urgent Care copay. $20 and $30 Tier 1 and Tier 2 drug copays.

SelectHealth Signature Benchmark Expanded 0 Copay Plan -- $0 deductible with maximum out-of-pocket expenses of $9,100. $40 and $90 office visit copays and $60 Urgent Care copay. $20 and $30 Tier 1 and Tier 2 drug copays. Tier 3 drug copay is $125. $75 diagnostic test copay.

Regence BCBS SaveWell Bronze 8500 -- $8,500 deductible and maximum out-of-pocket expenses of $9,100 and 50% coinsurance. $60 pcp office visit copay. Preferred generic and generic drug copays are $15 ($45 mail order). $100 Urgent Care copay.

Regence BCBS Bronze Virtual Value 7500 -- $7,500 deductible and maximum out-of-pocket expenses of $9,100 and 50% coinsurance. Preferred generic and generic drug copays are $15 ($45 mail order). $100 Urgent Care copay.

Regence BCBS Bronze Essential 8500 With 4 Copay No Deductible Office Visits -- $8,500 deductible and maximum out-of-pocket expenses of $9,100 and 10% coinsurance. $60 pcp office visit copay (First four pcp visits). Preferred generic and generic drug copays are $15 ($45 mail order). $60 Urgent Care copay.

Regence BCBS Bronze Standard Expanded Bronze -- $7,500 deductible and maximum out-of-pocket expenses of $9,000 and 50% coinsurance. $50 pcp office visit copay. Preferred generic and generic drug copays are $25 ($75 mail order). $75 Urgent Care copay.

University of Utah Health Plans Healthy Premier Bronze w.3 Copays -- $8,750 deductible with maximum out-of-pocket expenses of $9,100 and 40% coinsurance. $50 copay for first three pcp and Urgent Care visits. Tier 1 and Tier 2 drug copays are $35 and $50 ($70 and $100 mail order).

University of Utah Health Plans Healthy Preferred Bronze HSA -- HSA-eligible plan with $7,500 deductible and maximum out-of-pocket expenses of $7,500 and 0% coinsurance.

Cigna Connect4200 -- $4,200 deductible and maximum out-of-pocket expenses of $9,100 and 50% coinsurance. $3 preferred generic drug copay ($7.50 mail order).

Cigna Simple Choice 9100 -- $9,100 deductible and maximum out-of-pocket expenses of $9,100 and 0% coinsurance.

BridgeSpan Bronze Virtual Saver 8500 -- $8,500 deductible and maximum out-of-pocket expenses of $9,100 and 20% coinsurance. Preferred generic and generic drug copays are $15 ($45 mail order).

BridgeSpan Standard Expanded Bronze Plan -- $50 and $100 office visit copays with $75 copay for Urgent Care. $7,500 deductible with maximum out-of-pocket expenses of $9,000. Preferred generic and generic drug copays are $25 ($75 mail order). $50 copay for blood work. $135 copay for x-rays.

Silver Tier

Molina Constant Care Silver 7 250 -- $30 and $90 office visit copays with $30 copay for Urgent Care. $0 deductible with maximum out-of-pocket expenses of $8,550. Tier 1 and Tier 2 drug copays are $30 and $100. $50 copay for blood work. $135 copay for x-rays.

Molina Constant Care Silver 2 250 -- $30 and $65 office visit copays with $30 copay for Urgent Care. $5,200 deductible with maximum out-of-pocket expenses of $8,150 and 40% coinsurance. Tier 1 and Tier 2 drug copays are $25 and $65. $40 copay for blood work.

Molina Constant Care Silver 4 250 -- $30 and $65 office visit copays with $30 copay for Urgent Care. $7,450 deductible with maximum out-of-pocket expenses of $7,450 and 0% coinsurance. Tier 1 and Tier 2 drug copays are $25 and $75.

SelectHealth Value Benchmark Silver 6500 -- $25 and $60 office visit copays with $60 copay for Urgent Care and $600 copay for ER visits (All subject to deductible). $6,500 deductible with maximum out-of-pocket expenses of $8,550 and 50% coinsurance. Tier 1 and Tier 2 drug copays are $15 and $25.

SelectHealth Signature Benchmark Silver 0 Copay Plan -- $30 and $60 office visit copays with $40 copay for Urgent Care and $1,200 copay for ER visits. $3,500 deductible with maximum out-of-pocket expenses of $8,700. Tier 1 and Tier 2 drug copays are $15 and $25. Tier 3 drug copay is $100. $50 copay for diagnostic tests.

SelectHealth Signature Silver 2500 -- $35 and $60 office visit copays with $60 copay for Urgent Care (not subject to deductible). $2,500 deductible with maximum out-of-pocket expenses of $8,700 and 50% coinsurance. Tier 1 and Tier 2 drug copays are $15 and $25.

Cigna Connect 5500 -- $30 and $80 office visit copays with $50 copay for Urgent Care. $5,500 deductible with maximum out-of-pocket expenses of $8,700 and 50% coinsurance. Preferred generic and generic drug copays are $3 and $20 ($7.50 and $50 mail-order).

Cigna Connect 1900 -- $30 pcp office visit copay with $50 copay for Urgent Care. $1,900 deductible with maximum out-of-pocket expenses of $8,700 and 50% coinsurance. Preferred generic and generic drug copays are $3 and $20 ($7.50 and $50 mail order). Preferred brand drug copays are $80 and $240.

Cigna Connect 4200 -- $15 and $75 office visit copays with $35 copay for Urgent Care. $4,200 deductible with maximum out-of-pocket expenses of $8,700 and 40% coinsurance. Preferred generic and generic drug copays are $3 and $20 ($9 and $60 mail order).

Cigna Connect 3500 -- $10 and $80 office visit copays with $35 copay for Urgent Care. $3,500 deductible with maximum out-of-pocket expenses of $8,700 and 40% coinsurance. Preferred generic and generic drug copays are $3 and $20 ($9 and $60 mail order). Preferred brand drug copays are $70 and $210.

University Of Utah Health Plans Healthy Preferred Wasatch Silver -- $30 and $75 office visit copays with $30 copay for Urgent Care. $2,000 deductible with maximum out-of-pocket expenses of $8,700 and 50% coinsurance. Preferred generic drug copay is $25 ($50 mail order). Non-preferred generic and preferred brand drug copays are $40 ($80 mail order).

University Of Utah Health Plans Healthy Preferred Silver Copay -- $30 and $75 office visit copays with $30 copay for Urgent Care. $3,500 deductible with maximum out-of-pocket expenses of $8,000 and 40% coinsurance. Preferred generic drug copay is $15 ($30 mail order). Non-preferred generic and preferred brand drug copays are $30 ($60 mail order).

BridgeSpan Silver Essential 4000 HMO -- $45 office visit copays with $45 copay for Urgent Care. $4,000 deductible with maximum out-of-pocket expenses of $8,700 and 20% coinsurance. Preferred generic and generic drug copays are $10 ($20 mail order).

Regence BCBS SaveWell Silver 5500 EPO -- $15 pcp office visit copay with $80 copay for Urgent Care. $5,500 deductible with maximum out-of-pocket expenses of $8,700 and 10% coinsurance. Preferred generic and generic drug copays are $10 ($20 mail order).

Regence BCBS Silver 6500 -- $25 pcp office visit copay with $85 copay for Urgent Care. $6,500 deductible with maximum out-of-pocket expenses of $8,700 and 10% coinsurance. Preferred generic and generic drug copays are $10 ($20 mail order).

Bright Health Silver 4000 -- $35 pcp office visit copay with $50 copay for Urgent Care. $4,000 deductible with maximum out-of-pocket expenses of $8,700 and 40% coinsurance. $15 copay for preferred generic drugs.

Gold Tier

University of Utah Health Plans Healthy Preferred Gold Copay -- $25 and $40 office visit copays with $25 Urgent Care copay. $1,500 deductible with maximum out-of-pocket expenses of $7,000 and 20% coinsurance. A $15 copay applies to preferred generic drugs ($30 mail order). Non-preferred generic and preferred brand drug copays are $30 ($60 mail order).

University of Utah Health Plans Healthy Preferred Wasatch Gold -- $25 and $50 office visit copays with $25 Urgent Care copay. $2,700 deductible with maximum out-of-pocket expenses of $8,300 and 20% coinsurance. A $15 copay applies to preferred generic drugs ($30 mail order). Non-preferred generic and preferred brand drug copays are $30 ($60 mail order).

SelectHealth Select Value Gold 1500 no deductible for office visits -- $25 and $40 office visit copays with $40 copay for Urgent Care and $350 copay for ER visits. $1,500 deductible with maximum out-of-pocket expenses of $6,000 and 20% coinsurance. Tier 1 and Tier 2 drug copays are $15 and $25.

SelectHealth Select Gold 1500 no deductible for office visits -- $25 and $40 office visit copays with $40 copay for Urgent Care and $350 copay for ER visits. $1,500 deductible with maximum out-of-pocket expenses of $6,000 and 20% coinsurance. Tier 1 and Tier 2 drug copays are $15 and $25.

Molina Confident Care Gold 1 -- $10 and $50 office visit copays with $10 copay for Urgent Care. $2,100 deductible with maximum out-of-pocket expenses of $8,550 and 20% coinsurance. $15 copay for blood work. $10 copay for generic drugs. $50 copay for preferred brand drugs.

Cigna Connect 1800 -- $10 and $60 office visit copays with $40 copay for Urgent Care. $1,800 deductible with maximum out-of-pocket expenses of $8,700 and 20% coinsurance. $3 and $10 ($7.50 and $25 mail order) copays for preferred generic and generic drugs.

BridgeSpan Gold Starter HDHP 2000 -- $2,000 deductible with maximum out-of-pocket expenses of $7,000 and 10% coinsurance. HSA-eligible.

Regence BCBS Gold 2500 EPO -- $10 and $70 office visit copays with $70 copay for Urgent Care. $2,500 deductible with maximum out-of-pocket expenses of $8,700 and 10% coinsurance. $5 ($10 mail order) copays for preferred generic and generic drugs.

Bright Health Gold 1000 -- $0 and $40 (no charge first two specialist visits) office visit copays with $50 copay for Urgent Care. $1,000 deductible with maximum out-of-pocket expenses of $8,700 and 20% coinsurance. $0/$15 copays for preferred generic drugs, $50 copay for preferred brand and non-preferred generic drugs, and $125 copay for non-preferred brand and non-preferred generic drugs. Lab test and x-ray copays are $50 and $100.

Are Federal Subsidies Offered?

Yes. Actually, they are available in all states. Your modified adjusted gross income (MAGI) will determine your eligibility. For example, for Salt Lake City residents, if you are 35, single and make under $58,000, you should be eligible. A family of three (45,45, and 10) that earns less than $182,000 should also qualify. About 400,000 persons in the state qualify for the subsidy, and a higher number of persons are currently not covered on any type of medical plan.

NOTE: Your age can also impact the amount of your subsidy since premiums are higher for older persons (and thus, generate more financial aid). For example, in Davis County, a single 35 year-old making $25,000 per year is eligible for an approximate subsidy of $380 per month. However, a 45 year-old would receive about $489 while a 60 year-old could receive as much as $866, resulting in many inexpensive options.

It's paid in the form of a tax credit that is instantly deducted from the health insurance premium. Since the insurance company receives the credit directly, individuals and families don't have to wait to be reimbursed. However, if you underestimate your income, you may have to pay some of the subsidy money back. And if you overestimate your income, you may receive a larger credit than anticipated. NOTE: This credit typically arrives with your refund the following tax year.

If you don't qualify for a subsidy, then you can also buy a policy that is not listed on the Exchange. The major carriers offer these sets of plans to persons that may want a larger network of providers or a higher-deductible option. Medical coverage for young adults can also be found. With children's benefits, often keeping your set of providers is the most important factor in deciding which policy to purchase.

Are Temporary ID Cards Available?

Yes, they are. With most carriers, you can log into your online account and print the most recent policy information. It is also possible that you may be required to initially sign up and/or create an account. Your policy number, social security number and other identifying information also may be needed. Once the account is created, additional online services can be accessed, including billing and claims. Lost cards can be easily replaced and all family members (over the age of 15) should have their own ID cards.

Often, billing is one of the last portions of the enrollment process to be completed. If you have not received a bill seven days prior to your effective date, you should contact the carrier directly. Generally, you can make a payment online that will be processed within 24-48 hours, and ensure your initial premium is received. Electronic withdraw is very popular and helps avoid the potential of forgetting to pay your premium, which results in a lapse in coverage. Direct billing is also offered with no extra charges.

Can I Keep My Existing Plan?

If your existing policy is not being terminated (you will be notified in writing), many companies allowed you to keep your current plan. These "grandfathered" policies were issued prior to March 23, 2010 and often contained higher out-of-pocket expenses for hospital-related claims. Also, maternity and prenatal benefits were typically missing or limited. Mental health benefits were also limited, so if these coverages are important to have, applying and enrolling for Marketplace plans would be advantageous.

Of course, newer policies may be kept the following year unless that plan is discontinued by the carrier, or the carrier no longer offers coverage in your service area. Companies in many parts of the country will terminate a "block" of plans that may be extremely unprofitable, and replace them with a revised plan option. The Utah Department Of Insurance must approve new policy offerings. Also, it is possible that existing carriers will either leave the Marketplace or discontinue offering plans in specific counties.

Protections and benefits offered by ACA plans are often not found on older plans. However, rates are generally less-expensive for these policies because many unnecessary benefits are not included, and the plans are customized to meet specific needs. At any time, you may terminate a grandfathered plan and purchase new Marketplace coverage during Open Enrollment or a Special Enrollment Period (SEP). Non-Obamacare plans are available at all times.

What Was "Avenue H"?

Created nine years ago, this was the separate Exchange (also called "SHOP") for small business owners (1-50 employees) to shop for coverage on themselves and workers. New group quotes are no longer accepted, and existing groups received support until a few years ago. The SHOP Exchange replaced Avenue H, and offers enrollment throughout the entire year.

More than 800 small businesses and 14,000 members utilized this program to provide policies. Employers contributed a pre-determined amount of funds for their worker's healthcare and those workers could then contribute additional money to "upgrade" their coverage. More than 70 Avenue H plan options were available and the "Defined Benefit" approach was very popular. 33 dental and 3 HSA options were also offered.

Governor Herbert was very instrumental in convincing the federal government to allow the state of Utah to operate Avenue H. (Spencer J. Cox is current Governor). The state oversaw certifications, compliance, and much of the Medicaid program. The three participating carriers were UnitedHealthcare, HSA healthplan, and SelectHealth. Dental plans were offered by Alpha Dental, Delta Dental, DentalSelect, and Emi. HSA providers were HealthEquity, Optum Bank, and National Benefit Services. HSA healthplan offered policies in the Northwestern portion of the state, while UnitedHealthcare offered coverage in Utah, Salt Lake, Davis, and Weber Counties.

Avenue H was not designed to offer policies for the private sector that did not have group medical insurance. Utah has opted to allow its State Exchange to be federally-operated. This could change in future years, depending on the projected expenses and how much taxpayers in the state will have to pay, although we expect a continuation of the federal control. Currently, all of the tax advantages provided by Group coverage remain. The cost of a policy is paid with deductible pre-tax funds, and all of the HSA tax advantages are still available.

Utah Senior Medicare Health Insurance Options

Medigap plans are very popular in the Beehive State. Supplement, Advantage, and Part D Prescription Drug coverage is available from a wide variety of companies. Although rates, of course, periodically change, prices have remained fairly stable over the last five years. Listed below are the approved carriers that are authorized to issue Medicare Supplement coverage. Not all available plans (A-N and High Deductible F and G) are offered by each company.

Atlantic Coast Life

State Farm

United American

Great Southern Life

Humana

Regence BCBS

Philadelphia American

Mutual Of Omaha

National Health

Aetna

Capitol Life

State Mutual

AARP-UnitedHealthcare

Cigna

Manhattan Life

United States Fire

Union Security

Central States

Assured Life

GPM Health

Accendo

Bankers Fidelity Life

Guarantee Trust Life

Medico

Oxford Life

National Health

SBLI USA Life

Elips Life

American Benefit Life

Lumico Life

USAA

American Home Life

Illustrated below are estimated monthly rates for Medicare Supplement plans for all Utah counties. Prices shown are for a non-smoking 65 year-old female. Male rates are slightly higher.

Plan A

$70 -- AARP-UnitedHealthcare

$89 -- Humana

$94 -- SBLI USA Life

$96 -- United States Fire

$96 -- Accendo

$96 -- Elips Life

$97 -- Cigna

$99 -- Omaha Insurance

$100 -- Philadelphia American

$101 -- United American

$104 -- Capitol Life

$104 -- Manhattan Life

$112 -- Allstate

$112 -- GPM Health

$113 -- Union Security

$113 -- Regence BCBS

$114 -- Aetna

$118 -- Central States

$121 -- Great Southern Life

$123 -- Medico

$137 -- Bankers Fidelity

$151 -- Guarantee Trust Life

$154 -- Oxford Life

$183 -- Assured Life

Plan B

$120 -- AARP-UnitedHealthcare

$128 -- United States Fire

$148 -- Aetna

$169 -- United American

$242 -- Sentinel Security

$243 -- Assured Life

Plan C

$118 -- AARP-UnitedHealthcare

$147 -- Western United Life

$159 -- Regence BCBS

$227 -- Assured Life

Plan D

$105 -- Philadelphia American

$182 -- Assured Life

Plan F

$115 -- Capitol Life

$120 -- Great Southern Life

$123 -- Union Security

$124 -- AARP-UnitedHealthcare

$125 -- Lumico Life

$127 -- Humana

$132 -- Thrivent

$138 -- Great Southern Life

$143 -- Aetna

$143 -- Guarantee Trust Life

$153 -- Lumico Life

$157 -- Mutual Of Omaha

$158 -- Transamerica

$160 -- Regence BCBS

$167 -- Philadelphia American

$188 -- Oxford Life

Plan F (High Deductible)

$33 -- Great Southern Life

$35 -- Mutual Of Omaha

$38 -- Philadelphia American

$39 -- Humana

$54 -- Aetna

Plan G

$92 -- Capitol Life

$95 -- Union Security

$97 -- Lumico Life

$98 -- Humana

$99 -- AARP-UnitedHealthcare

$99 -- Great Southern Life

$99 -- Aetna

$103 -- Cigna

$104 -- Thrivent

$111 -- Western United Life

$113 -- Guarantee Trust Life

$117 -- Mutual Of Omaha

$122 -- Oxford Life

$123 -- Regence BCBS

$140 -- Medico

$140 -- Philadelphia American

$171 -- Assured Life

Plan G (High Deductible)

$30 -- Mutual Of Omaha

$31 -- Philadelphia American

$39 -- Humana

Plan K

$34 -- AARP-UnitedHealthcare

$81 -- Regence BCBS

Plan L

$72 -- AARP-UnitedHealthcare

$102 -- Humana

$128 -- United American

Plan N

$86 -- AARP-UnitedHealthcare

$88 -- Transamerica

$92 -- Manhattan Life

$99 -- Mutual Of Omaha

$99 -- American Retirement Life

$101 -- Humana

$103 -- Central States

$104 -- American Continental

$104 -- CSI Life

$104 -- Equitable

$105 -- Medico

$128 -- Oxford Life

$143 -- United American

Utah Medicare Advantage Plans

Part C MA contracts are also very popular. Offered by private insurers, these policies often include dental, vision, and hearing benefits, along with several wellness perks. Many plans also include prescription drug coverage. Prices, benefits, and availability of plans shown, may differ, depending upon your county of residence. We have listed below several Advantage options that include prescription drug benefits:

AARP Medicare Advantage Choice -- $0 deductible and maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $450 per day for the first five days. The outpatient hospital copay is $0-$400. Office visit copays are $0 and $50, and the ER and Urgent Care copays are $90 and $40. The lab service copay is $0 and the outpatient x-ray copay is $15. Outpatient mental health individual and group copays are $25 and $15. Occupational, physical, and speech and hearing therapy copays are $20. Dental, vision, and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $0 (Tier 1), $10 (Tier 2), $45, (Tier 3), $100 (Tier 4), and 33% (Tier 5). 2,446 total members. 3.5 Star Summary Rating.

AARP Medicare Advantage Plan 1 -- $0 deductible and maximum out-of-pocket expenses of $4,500. Inpatient hospital copay is $290 per day for the first five days. The outpatient hospital copay is $0-$275. Office visit copays are $0 and $25, and the ER and Urgent Care copays are $90 and $40. The lab service copay is $0 and the outpatient x-ray copay is $15. Outpatient mental health individual and group copays are $25 and $15. Occupational, physical, and speech and hearing therapy copays are $20. Preventative dental, vision, and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $0 (Tier 1), $10 (Tier 2), $45, (Tier 3), $95 (Tier 4), and 33% (Tier 5). 41,710 total members. 4.5 Star Summary Rating.

AARP Medicare Advantage Plan 2 -- $0 deductible and maximum out-of-pocket expenses of $4,900. Inpatient hospital copay is $345 per day for the first five days. The outpatient hospital copay is $0-$325. Office visit copays are $0 and $30, and the ER and Urgent Care copays are $90 and $40. The lab service copay is $0 and the outpatient x-ray copay is $15. Outpatient mental health individual and group copays are $25 and $15. Occupational, physical, and speech and hearing therapy copays are $20. Preventative dental, vision, and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $0 (Tier 1), $10 (Tier 2), $45, (Tier 3), $95 (Tier 4), and 33% (Tier 5). 41,710 total members. 4.5 Star Summary Rating.

AARP Medicare Advantage Walgreens 2 -- $0 deductible and maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $360 per day for the first five days. The outpatient hospital copay is $0-$340. Office visit copays are $0 and $40, and the ER and Urgent Care copays are $90 and $40. The lab service copay is $0 and the outpatient x-ray copay is $15. Outpatient mental health individual and group copays are $25 and $15. Occupational, physical, and speech and hearing therapy copays are $20. Preventative dental, vision, and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $0 (Tier 1), $0 (Tier 2), $47, (Tier 3), $100 (Tier 4), and 33% (Tier 5). 5,333 total members. 4.5 Star Summary Rating.

Advantage U Signature -- $200 deductible and maximum out-of-pocket expenses of $6,900. Inpatient hospital copay is $325 per day for the first four days. The outpatient hospital copay is $325. Office visit copays are $0 and $25, and the ER and Urgent Care copays are $90 and $45. The lab service copay is $0 and the outpatient x-ray copay is $5. Outpatient mental health individual and group copays are $10. Occupational, physical, and speech and hearing therapy copays are $25. Preventative dental, vision, and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $3 (Tier 1), $10 (Tier 2), $47, (Tier 3), $100 (Tier 4), and 29% (Tier 5).

Aetna Medicare Elite Plan -- $0 deductible and maximum out-of-pocket expenses of $4,900. Inpatient hospital copay is $390 per day for the first five days. The outpatient hospital copay is $40-$295. Office visit copays are $0 and $40, and the ER and Urgent Care copays are $90 and $40. The lab service copay is $0 and the outpatient x-ray copay is $0. Outpatient mental health individual and group copays are $40. Occupational, physical, and speech and hearing therapy copays are $40. Dental, vision, and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $0 (Tier 1), $0 (Tier 2), $47, (Tier 3), $100 (Tier 4), and 33% (Tier 5).

Aetna Advantra -- $100 deductible and maximum out-of-pocket expenses of $5,500. Inpatient hospital copay is $375 per day for the first five days. The outpatient hospital copay is $225. Office visit copays are $0 and $45, and the ER and Urgent Care copays are $90 and $45. The lab service copay is $0 and the outpatient x-ray copay is $10. Outpatient mental health individual and group copays are $40. Occupational, physical, and speech and hearing therapy copays are $40. Dental, vision, and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $0 (Tier 1), $10 (Tier 2), $47, (Tier 3), $100 (Tier 4), and 31% (Tier 5).

Aetna Medicare Choice Plan -- $100 deductible and maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $390 per day for the first five days. The outpatient hospital copay is $45-$350. Office visit copays are $0 and $45, and the ER and Urgent Care copays are $90 and $45. The lab service copay is $0 and the outpatient x-ray copay is $10. Outpatient mental health individual and group copays are $40. Occupational, physical, and speech and hearing therapy copays are $40. Dental, vision, and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $0 (Tier 1), $10 (Tier 2), $47, (Tier 3), $100 (Tier 4), and 31% (Tier 5).

Cigna True Choice Medicare -- $0 deductible and maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $330 per day for the first five days. The outpatient hospital copay is $0-$330. Office visit copays are $0 and $35, and the ER and Urgent Care copays are $90 and $30. The lab service copay is $0 and the outpatient x-ray copay is $0. Outpatient mental health individual and group copays are $0. Occupational, physical, and speech and hearing therapy copays are $35. Dental, vision, and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $0 (Tier 1), $5 (Tier 2), $47, (Tier 3), $100 (Tier 4), and 33% (Tier 5).

Humana Gold Plus -- $200 deductible and maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $400 per day for the first four days. The outpatient hospital copay is $5-$400. Office visit copays are $0 and $45, and the ER and Urgent Care copays are $90 and $0-$45. The lab service copay is $0 and the outpatient x-ray copay is $0-$15. Outpatient mental health individual and group copays are $40. Occupational, physical, and speech and hearing therapy copays are $40. Vision and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $4 (Tier 1), $15 (Tier 2), $47, (Tier 3), $100 (Tier 4), and 29% (Tier 5).

HumanaChoice -- $200 deductible and maximum out-of-pocket expenses of $5,900. Inpatient hospital copay is $450 per day for the first four days. The outpatient hospital copay is $5-$450. Office visit copays are $0 and $50, and the ER and Urgent Care copays are $90 and $0-$50. The lab service copay is $0 and the outpatient x-ray copay is $0-$15. Outpatient mental health individual and group copays are $40. Occupational, physical, and speech and hearing therapy copays are $40. Vision, preventative dental, and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $4 (Tier 1), $15 (Tier 2), $47, (Tier 3), $100 (Tier 4), and 29% (Tier 5).

Molina Medicare Choice Care -- $0 deductible and maximum out-of-pocket expenses of $5,400. Inpatient hospital copay is $295 per day for the first six days. The outpatient hospital copay is $225. Office visit copays are $0 and $40, and the ER and Urgent Care copays are $90 and $40. The lab service copay is $5 and the outpatient x-ray copay is $5. Outpatient mental health individual and group copays are $40. Occupational, physical, and speech and hearing therapy copays are $40. Vision, dental, and hearing visits are covered, subject to policy limits. The 30-day prescription drug cost-sharing copays are $2 (Tier 1), $8 (Tier 2), $45, (Tier 3), $100 (Tier 4), and 33% (Tier 5).

Utah Medicare Part D (Prescription Drug) Plans

Humana Walmart Value Rx Plan -- Monthly premium of $40.60 with $545 deductible (not applicable to Tier 1 and 2 drugs). 30-day supply cost-sharing copays are $0 (Tier 1), $1 (Tier 2), 15% (Tier 3), 48% (Tier 4), and 25% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $3 (Tier 2), 15% (Tier 3), 48% (Tier 4), and n/a (Tier 5). 3,175 available formulary drugs. 5,833 Utah members enrolled in plan.

Humana Premier Rx Plan -- Monthly premium of $81.70 with $500 deductible. 30-day supply cost-sharing copays are $1 (Tier 1), $4 (Tier 2), $45 (Tier 3), 35% (Tier 4), and 25% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $0 (Tier 2), $125 (Tier 3), 35% (Tier 4), and n/a (Tier 5). 3,260 available formulary drugs.

Humana Basic Rx Plan -- Monthly premium of $42.70 with $505 deductible. 30-day supply cost-sharing copays are $0 (Tier 1), $1 (Tier 2), 19% (Tier 3), 37% (Tier 4), and 25% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $0 (Tier 2), 15% (Tier 3), 30% (Tier 4), and n/a (Tier 5). 3,150 available formulary drugs.

Elixir RxSecure -- Monthly premium of $76.70 with $100 deductible. 30-day supply cost-sharing copays are $1 (Tier 1), $4 (Tier 2), 15% (Tier 3), 28% (Tier 4), and 25% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $6 (Tier 2), 15% (Tier 3), 28% (Tier 4), and n/a (Tier 5).

AARP MedicareRx Walgreens (UnitedHealthcare) -- Monthly premium of $29.40 with $310 deductible. 30-day supply cost-sharing copays are $0 (Tier 1), $10 (Tier 2), $40 (Tier 3), 40% (Tier 4), and 27% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $30 (Tier 2), $120 (Tier 3), 40% (Tier 4), and n/a (Tier 5).

AARP MedicareRx Saver Plus (UnitedHealthcare) -- Monthly premium of $40.00 with $480 deductible. 30-day supply cost-sharing copays are $1 (Tier 1), $6 (Tier 2), $39 (Tier 3), 40% (Tier 4), and 25% (Tier 5). 90-day supply cost-sharing mail-order copays are $3 (Tier 1), $18 (Tier 2), $117 (Tier 3), 40% (Tier 4), and n/a (Tier 5).

AARP MedicareRx Preferred (UnitedHealthcare) -- Monthly premium of $101.20 with $0 deductible. 30-day supply cost-sharing copays are $5 (Tier 1), $10 (Tier 2), $45 (Tier 3), 40% (Tier 4), and 33% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $0 (Tier 2), $120 (Tier 3), 40% (Tier 4), and n/a (Tier 5).

SilverScript Choice -- Monthly premium of $34.10 with $480 deductible. 30-day supply cost-sharing copays are $0 (Tier 1), $5 (Tier 2), 17% (Tier 3), 35% (Tier 4), and 25% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $0 (Tier 2), $120 (Tier 3), 50% (Tier 4), and n/a (Tier 5).

SilverScript Plus -- Monthly premium of $62.00 with $0 deductible. 30-day supply cost-sharing copays are $0 (Tier 1), $2 (Tier 2), $47 (Tier 3), 50% (Tier 4), and 33% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $0 (Tier 2), $120 (Tier 3), 50% (Tier 4), and n/a (Tier 5).

SilverScript SmartRx -- Monthly premium of $6.90 with $480 deductible. 30-day supply cost-sharing copays are $1 (Tier 1), $19 (Tier 2), $46 (Tier 3), 49% (Tier 4), and 25% (Tier 5). 90-day supply cost-sharing mail-order copays are $3 (Tier 1), $57 (Tier 2), $138 (Tier 3), 49% (Tier 4), and n/a (Tier 5).

WellCare Classic -- Monthly premium of $34.60 with $480 deductible. 30-day supply cost-sharing copays are $0 (Tier 1), $6 (Tier 2), $37 (Tier 3), 36% (Tier 4), and 25% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $18 (Tier 2), $111 (Tier 3), 36% (Tier 4), and n/a (Tier 5).

WellCare Value Script -- Monthly premium of $11.30 with $480 deductible. 30-day supply cost-sharing copays are $0 (Tier 1), $4 (Tier 2), $42 (Tier 3), 47% (Tier 4), and 25% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $12 (Tier 2), $126 (Tier 3), 47% (Tier 4), and n/a (Tier 5).

WellCare Medicare Rx Value Plus -- Monthly premium of $68.90 with $0 deductible. 30-day supply cost-sharing copays are $0 (Tier 1), $4 (Tier 2), $47 (Tier 3), 50% (Tier 4), and 33% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $10 (Tier 2), $117.50 (Tier 3), 49% (Tier 4), and n/a (Tier 5).

Cigna Secure-Essential Rx -- Monthly premium of $24.00 with $445 deductible. 30-day supply cost-sharing copays are $0 (Tier 1), $2 (Tier 2), 18% (Tier 3), 44% (Tier 4), and 25% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $0 (Tier 2), 18% (Tier 3), 44% (Tier 4), and n/a (Tier 5).

Cigna Secure Rx -- Monthly premium of $37.70 with $445 deductible. 30-day supply cost-sharing copays are $1 (Tier 1), $2 (Tier 2), $38 (Tier 3), 50% (Tier 4), and 25% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $0 (Tier 2), $114 (Tier 3), 50% (Tier 4), and n/a (Tier 5).

Cigna Secure-Extra Rx -- Monthly premium of $48.60 with $100 deductible. 30-day supply cost-sharing copays are $4 (Tier 1), $10 (Tier 2), $42 (Tier 3), 50% (Tier 4), and 50% (Tier 5). 90-day supply cost-sharing mail-order copays are $0 (Tier 1), $2 (Tier 2), $126 (Tier 3), 49% (Tier 4), and n/a (Tier 5).

Regence Medicare Script Enhanced -- Monthly premium of $123.50 with $0 deductible. 30-day supply cost-sharing copays are $3 (Tier 1), $10 (Tier 2), $47 (Tier 3), 40% (Tier 4), and 33% (Tier 5). 90-day supply cost-sharing mail-order copays are $6 (Tier 1), $20 (Tier 2), $117.50 (Tier 3), 40% (Tier 4), and n/a (Tier 5).

Regence Medicare Script Basic -- Monthly premium of $93.50 with $300 deductible. 30-day supply cost-sharing copays are $3 (Tier 1), $10 (Tier 2), $40 (Tier 3), 30% (Tier 4), and 27% (Tier 5). 90-day supply cost-sharing mail-order copays are $6 (Tier 1), $20 (Tier 2), $100 (Tier 3), 30% (Tier 4), and n/a (Tier 5).

Utah Short-Term Health Insurance

Rates illustrated below are monthly for Salt Lake City. Prices can vary throughout the state.

35-Year-Old Female

$63 -- National General $5,000 deductible with $1 million maximum policy benefits and 20% coinsurance

$83 -- National General $5,000 deductible with $1 million maximum policy benefits and 0% coinsurance

$104 -- National General $2,500 deductible with $1 million maximum policy benefits and 20% coinsurance

$116 -- Independence American $2,500 deductible with $1 million maximum policy benefits and 50% coinsurance

45-Year-Old Male

$96 -- National General $5,000 deductible with $1 million maximum policy benefits and 20% coinsurance

$128 -- National General $5,000 deductible with $1 million maximum policy benefits and 0% coinsurance

$167 -- National General $2,500 deductible with $1 million maximum policy benefits and 20% coinsurance

$199 -- Independence American $2,500 deductible with $1 million maximum policy benefits and 50% coinsurance

55-Year-Old Female

$158 -- National General $5,000 deductible with $1 million maximum policy benefits and 20% coinsurance

$209 -- National General $5,000 deductible with $1 million maximum policy benefits and 0% coinsurance

$266 -- National General $2,500 deductible with $1 million maximum policy benefits and 20% coinsurance

$351 -- National General $2,500 deductible with $1 million maximum policy benefits and 0% coinsurance

45-Year-Old Married Couple

$264 -- National General $5,000 deductible with $1 million maximum policy benefits and 20% coinsurance

$283 -- Independence American $5,000 deductible with $1 million maximum policy benefits and 50% coinsurance

$348 -- National General $2,500 deductible with $1 million maximum policy benefits and 20% coinsurance

$378 -- Independence American $2,500 deductible with $1 million maximum policy benefits and 50% coinsurance

55-Year-Old Married Couple

$337 -- National General $5,000 deductible with $1 million maximum policy benefits and 20% coinsurance

$445 -- National General $5,000 deductible with $1 million maximum policy benefits and 0% coinsurance

$567 -- National General $2,500 deductible with $1 million maximum policy benefits and 20% coinsurance

$750 -- National General $2,500 deductible with $1 million maximum policy benefits and 0% coinsurance

Updates From The Past:

Online enrollment for coverage is taking less time with far fewer delays and glitches. Although scattered issues are being reported, we are seeing a process that is much smoother compared to the initial roll-out in October.

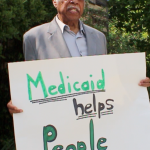

However, applicants that are eligible for Medicaid should automatically be transferred to the State Agency that handles the program. Currently, that is not occurring and the Department of Workforce Services is unable to determine eligibility. Temporarily, any Utah resident who believes they should qualify for Medicaid, should directly contact the Department.

Medicaid expansion in Utah may become a reality in the future. Governor Herbert and the federal government (HHS) are attempting to jointly approve a plan that would satisfy all parties. If approved, the new legislation would provide low-cost coverage to thousands of residents that currently are not Medicaid-eligible because of their household income. "Healthy Utah" could become law if expansion is approved. But since only partial expansion is proposed, federal funding is not available.

Governor Gary Herbert's Medicaid expansion idea ("Healthy Utah") that would provide private coverage to many of the state's uninsured was not approved by the Utah health panel. However, the reform task force recommended two separate ideas that would be less costly to most residents. The Governor's plan would have cost taxpayers almost $80 million within the next seven years, and perhaps taken away needed funds for public education.

The upcoming legislative session will provide another opportunity for the Governor to try to sway some opinions so the bill can be passed. He believes that his proposal will cover more persons and it makes sense to utilize government funds that have been offered. The debate is expected to continue while almost 150,000 people wait to take advantage of a program that can't be passed.

Utah companies have filed their rate requests with the Department of Insurance. Although the entire amount of these increases will unlikely be approved, prices will be going up. Shown below are several just-filed requests (within the last 30 days):

58% -- Arches Individual POS

36% -- Time (Assurant) Individual

23% -- SelectHealth Individual

22% -- Regence BlueCross BlueShield Direct Gold

22% -- BridgeSpan Exchange Gold

20% -- SelectHealth Minimum Individual

19% -- Aetna Peak Preference AltiusOne

18% -- HumanaOne Individual

12.5% of Utah residents were without healthcare coverage last year, which was down slightly from 14.0% the previous year. Although the state has not expanded Medicaid eligibility, federal subsidies continue to reduce premiums for household that qualify.

Also, The Brigham Young University student health plan currently available for the academic year has been determined to be non-compliant with ACA requirements. Thus, policyholders will be subject to a federal tax penalty for being uninsured. College medical plans were grandfathered until September 1, 2015. However, many University plans have not made the appropriate changes to become compliant.

Utah Access Plus, the proposed Medicaid expansion program for the state, may not get enough votes to pass, due to the amount of new taxes needed to run the program. For the last three years, the concept has been discussed and debated, and most residents seem to approve its implementation.

About $50 million in taxes would have to be payed by drug companies, hospitals, physicians, and other facilities in order to receive federal government funding of about $450 million. Those funds would help low-income families (less than 138% of Federal Poverty Level) qualify for subsidized health insurance benefits.

CO-OP Arches Health Plan has ceased operations and will not offer Marketplace plans in Utah. The DOI has placed the carrier in receivership, and current policyholders have until December 15th to select another company. There will be no lapse in coverage since their benefits should continue through December 31st. Bridgespan and Altius also announced that they will only offer off-Exchange policies.

Humana is not offering Marketplace plans. However, Group and several ancillary options will be available. The three major participating companies will be Molina, SelectHealth, and University of Utah Health Plans. Once again, about four out of five applicants will be eligible for financial subsidies.

The mandate requiring consumers to purchase qualified health insurance has been repealed. Therefore, the tax penalty (2.5% of household income) will end.