Save money on your individual or family health insurance coverage. Instantly compare the most affordable 2024 plans from multiple companies in all states, and easily enroll for under-65 or Senior coverage. Online shopping for medical benefits saves you time and money. Pre-existing conditions are covered on all qualified on and off Marketplace policies and many low-cost policies are offered. Medicare Supplement plans are standardized, although rates can widely vary, based on your age, state of residence, and specific plan chosen. MA and Part D plans are also offered to Seniors.

The combination of the federal tax subsidy (Obmacare) and properly enrolling in the right Exchange plan, provides quality comprehensive contracts at the cheapest available price. You do not have to meet underwriting guidelines to qualify, and there are options available for everyone's budget. Even if you missed the 2023 Open Enrollment deadline, many budget plans are available. Also, you can choose to select "non-compliant" non-Obamacare plans that often feature larger provider networks and more flexibility, without federal government involvement. They are available at any time throughout the year.

A "Special Enrollment Period" is offered to any individual that qualifies for special "life-changing events." For example, having a baby, moving to a different state, losing existing qualified medical benefits through your employer, reaching age 26 on a parent's policy, or becoming divorced, will generate the exception. You will have approximately two months to choose an Exchange policy offered in your state. No waiting periods, exclusions, or charges will apply.

You may also enroll in a non-compliant or Christian sharing plan, although initially, pre-existing conditions may not be covered. Ministry plans are not regulated by state governments, and submitted claims are not guaranteed to be paid. Also, premiums are often higher than Marketplace plans that qualify for subsidies. The largest US sharing plans are Medi-Share, Liberty HealthShare, Christian Healthcare Ministries, and Samaritan Ministries. Plans can be purchased through their websites or licensed brokers. Waiting periods may apply to specific conditions.

NOTE: If you become pregnant, the newborn automatically becomes eligible for an SEP exception and any medical conditions will be covered. However, the parent does not qualify for an exemption. Low-income adults may be eligible for Medicare, which can be obtained at any time throughout the year. The child, once born, may also become eligible for government coverage. A subsidy may help lower the premium, depending on the household income. Pediatric dental and vision benefits may also be offered.

Costs of coverage for young adults and children are always lower than adult rates. The location of the applicant also greatly determines the rate and availability of carriers. Medicaid income eligibility guidelines vary, depending upon your state of residency. Medicaid-expansion states have lower income requirements and coverage is available outside of Marketplace Open Enrollment periods. Supplementary, vision, and dental contracts can be issued separately. The maximum deductible for 2024 Marketplace plans is $9,450.

Free Subsidy Money

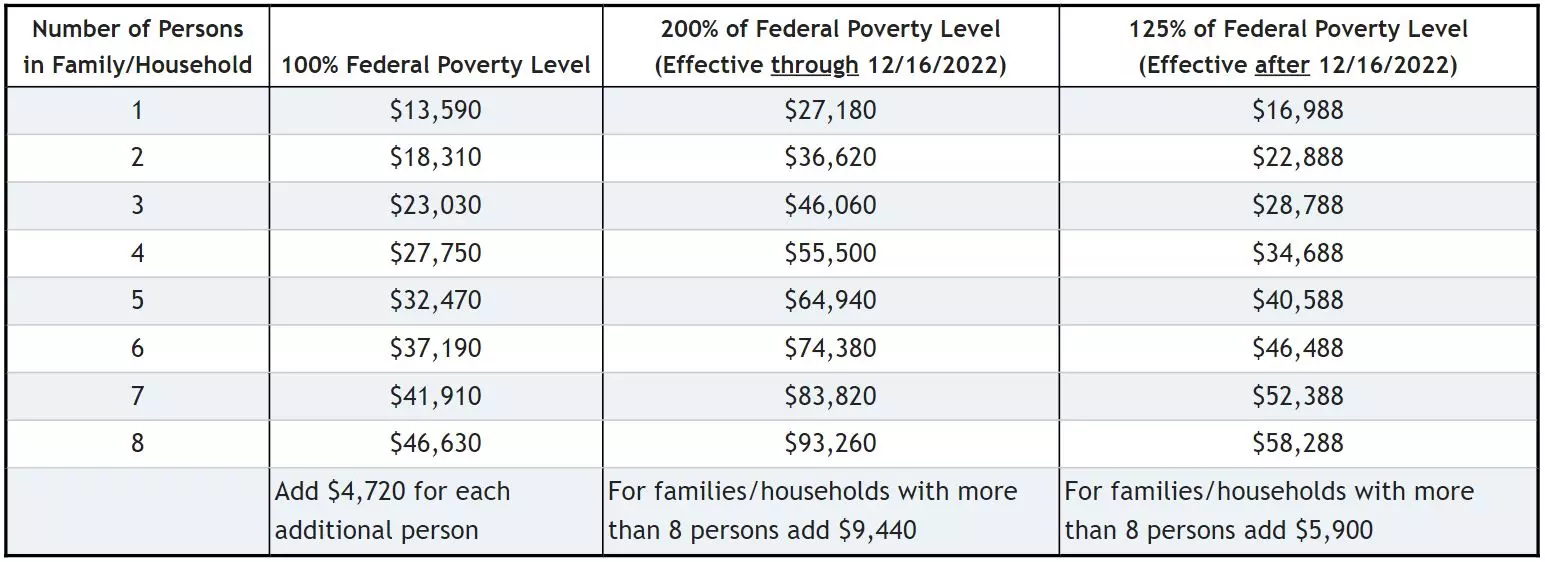

Understanding the Federal Government Marketplace subsidy and how to use it, is a great place to start. To qualify, your household income must fall between 100% and 400% of the Federal Poverty Level. So What are the magic numbers and what happens if you are just above or just below the limits? And what if your state expanded Medicaid eligibility? Low-cost economical options may also become available, depending on the success of future legislation. Newer Senior Medicare plans may also be offered for persons that have reached age 65.

The graphic below (courtesy of LegUp) shows the different income levels that will earn financial aid. For example, a household with four family members and an income above $95,000 may not qualify. However, a five-member household can earn about $110,000. There are additional variables that must be considered, including the ages of the adults, zip code, and cost of benchmark coverage (second-lowest Silver plan). Each state will have different levels of eligibility, which can periodically change.

If you move to a different state, it is possible that your federal subsidy amount may change. Substantial changes in household income, or removal or addition of dependents can have an immediate impact, and eligibility for other government programs may become available (CHIP). Also, if the current administration introduces new plan options for Americans, gradually, these changes may take effect in 2025. Cheaper plans are likely to be offered if the 10 mandated "essential health benefits" are no longer required on each "compliant" policy. Selling policies across state lines may also be implemented.

Even though this aid is classified as a tax credit, the actual money is deducted directly from your health insurance premium. Therefore, you do not have to wait to file your taxes in order to receive reimbursement. If you overestimate your income when calculating the subsidy, the following year, an adjustment will be made. Likewise, if you underestimate the subsidy, a credit will be given at the time you file your federal income tax return. The dollar amount may be substantial, considering the higher subsidies.

You can not project income from a job that you hope to secure in the future. Often, the name and address of the employer is required for automated verification. Spouse and dependent dates of birth and social security numbers are also required. Proof of US citizenship is required in rare cases. If a "Special Enrollment Period" applies, proof of prior qualified coverage (if applicable) will be required. At the end of the calendar year, you may re-apply for a different plan or retain your existing plan (if offered).

Deliberately understating income for the purpose of obtaining a higher subsidy is also not allowed. Your projected income for the upcoming year determines the subsidy and not your income from the prior year. For example, if your annual household income is $125,000 at the time you are applying, but because of retirement or other reasons, the income the following year will reduce to $60,000, your subsidy is based on the lower amount. If the incomes were reversed, the projected household income for the year of coverage, is what is counted.

If you have a significant change in income during the year, you can request to increase or lower your current subsidy. Also, an event may occur during the calendar year that changes the amount of aid you may receive. For example, you may unexpectedly retire, work more overtime, or get a raise. A dependent may move out of the home, or you may sell assets that result in a large capital gain. All of these situations allow you to adjust the level of financial aid you are receiving, even if the Open Enrollment period has ended. The process is simple and takes less than 10 minutes.

Don't Forget Tax Forms

Two tax forms are required to be filed the year after you receive a federal subsidy. Form 1095-A is used to enter household income and plan information. The date is then transferred to Form 8962 (Premium Tax Credit) which references your subsidies. Previously, there was an entry on the 1040 tax form requesting if you secured healthcare coverage. If you answered "no," an additional tax was likely to be applied to your household income. However, you were not charged for the first three months of being uninsured. Also, enforcement of this violation was sporadic, and three years ago, the mandate was terminated. Thus, purchasing qualified healthcare is no longer required.

NOTE: If you overestimate or underestimate your household income, and therefore receive an incorrect amount of subsidy, the following year when you file your taxes, the shortfall (or credit) will be adjusted. This will result in an increased refund, or a higher amount of taxes owed. There is no penalty, assuming you were not fraudulently and deliberately miscalculating the subsidy. Each year during Open Enrollment, if possible, your household income for the following year should be re-projected, so your upcoming subsidy is accurate. If someone in the household is retiring, or a dependent has moved out of the household, the amount of subsidy will be heavily impacted.

Bigger Credits For Bigger Families

Since all household members are considered, regardless if they are applying for coverage, obviously the larger the family, the bigger the subsidy will be. Therefore, if one spouse is retired and already receiving Social Security benefits (and Medicare), or they are covered under a group plan, it still helps when determining how much money you will receive. Or, if one or more children are covered under CHIP or Medicaid, your subsidy will be increased.

Typically, if they appear on your federal tax return, they count towards calculating the subsidy. When dependents get married, or move out of the household, generally, they are no longer considered when calculating the credit status. It is possible that a dependent can file a separate tax return and continue to remain under a parent's policy (until age 26). Once age 26 is reached, a separate policy can be issued with full subsidy-eligibility.

Also, if you declare these children as dependents on your tax return, even if they are over the age of 18 and not a full-time student, it will increase the amount of your "free money." However, income that your children earn, may have to be counted in the subsidy calculation. Of course, typically, the amount of money they make is easily offset by your tax credit reimbursement. If one child earns significant income, it will impact the subsidy that the entire family receives. Children that file their own tax return, are not considered as dependents, when calculating your subsidy. It is possible that they may qualify for financial assistance, while other family members don't.

Medicare Supplement Insurance For Seniors

Persons that have reached age 65 and are enrolled in Parts A and Part B, can apply for Medigap coverage. While "Advantage" plans replace original Medicare benefits, a Supplement contract works with provided Medicare benefits to help pay out-of-pocket expenses. A separate Part D drug prescription plan must also be purchased. NOTE: Persons currently enrolled in an Advantage plan can terminate the policy and apply for Supplement coverage during Open Enrollment. However, after December 15th, the current plan can not be changed, unless a special enrollment exception is available.

Comparing Supplement plans in much easier than comparing a Marketplace plan, since each type of policy is standardized, with the only differences being the cost, and network provider area. Wisconsin, Minnesota, and Massachusetts utilize different standardized guidelines. There are 10 different plan options, although "F" contracts also offer a high-deductible option. This plan (F-HD) is the least expensive of all options. For plans issued in 2020 or later, the high-deductible plan used is G (HD).

After $2,900 of out-of-pocket expenses have been paid, Plans F and G (HD) pay 100% of covered expenses. The most popular plan option is F, followed by N, D, G, H, I, J, and C. Companies with the highest number of in-force Supplement plans are UnitedHealthcare, BCBS, Mutual Of Omaha, Aetna, Conseco (Bankers), and Cigna. However, many smaller carriers (Medico, Great Southern Life, Allstate, and Accendo) offer extremely competitive rates in specific areas and for specific plans.

Prices in each state are different, with age and smoking status also impacting premiums. Plan costs are also different, since benefits and out-of-pocket expenses can vary from one contract to another. Additional discounts may also apply to the prices shown. Listed below are the least expensive monthly rates for all available plans from selected areas, based on a non-smoking male (age 65):

Indianapolis, Indiana (Marion County) Medicare Supplement (Medigap) Monthly Rates

Plan A -- $91 (UnitedHealthcare) and $97 (Mutual Of Omaha)

Plan B -- $147 (Aetna) and $152 (UnitedHealthcare)

Plan C -- $144 (New Era Life) and $183 (UnitedHealthcare)

Plan D -- $127 (United American) and $252 (Heartland National Life)

Plan F -- $122 (Ace Property And Casualty) and $127 (Physicians Life)

Plan HDF -- $35 (New Era Life) and $41 (Medico)

Plan G -- $106 (UnitedHealthcare) and $106 (Ace Property And Casualty)

Plan HDG -- $35 (New Era Life) and $38 (United American)

Plan K -- $55 (UnitedHealthcare) and $62 (US Fire)

Plan L -- $78 (United States Fire) and $92 (UnitedHealthcare)

Plan N -- $80 (Ace Property And Casualty) and $84 (Allstate)

Jacksonville, Florida (Duval County) Medigap Monthly Rates

Plan A -- $161 (UnitedHealthcare) and $166 (New Era Life)

Plan B -- $215 (Continental Life) and $263 (United American)

Plan F -- $225 (New Era Life) and $228 (UnitedHealthcare)

Plan HDF -- $58 (United American) and $67 (Cigna)

Plan G -- $189 (UnitedHealthcare) and $199 (S. USA Life)

Plan HDG -- $58 (United American) and $70 (Humana)

Plan N -- $147 (AFLAC) and $149 (Cigna)

Charlotte, North Carolina (Mecklenburg County) Medigap Monthly Rates

Plan A -- $96 (UnitedHealthcare) and $96 (Allstate)

Plan B -- $120 (Aetna) and $128 (US Fire)

Plan C -- $122 (New Era Life) and $132 (UnitedHealthcare)

Plan F -- $113 (Cigna) and $117 (Allstate)

Plan HDF -- $33 (New Era Life) and $35 (Great Southern Life)

Plan G -- $97 (Allstate) and $101 (Cigna)

Plan HDG -- $32 (New Era Life) and $35 (Medico)

Plan K -- $50 (US Fire) and $51 (UnitedHealthcare)

Plan L -- $63 (US Fire) and $85 (UnitedHealthcare)

Plan N -- $72 (Cigna) and $75 (Allstate)

Cincinnati, Ohio (Hamilton County) Medigap Monthly Rates

Plan A -- $80 (UnitedHealthcare) and $100 (Mutual Of Omaha)

Plan B -- $121 (UnitedHealthcare) and $139 (Continental Life)

Plan C -- $154 (UnitedHealthcare) and $176 (Heartland National Life)

Plan F -- $131 (SBLI USA Life) and $133 (Ace Property And Casualty)

Plan HDF -- $37 (New Era Life) and $37 (United American)

Plan G -- $108 (UnitedHealthcare) and $115 (Elips Life)

Plan HDG -- $37 (New Era Life) and $37 (United American)

Plan K -- $46 (UnitedHealthcare) and $57 (United States Fire)

Plan L -- $94 (UnitedHealthcare) and $156 (United American)

Plan N -- $84 (Cigna) and $85 (UnitedHealthcare)

Oklahoma City, Oklahoma (Oklahoma County) Medigap Monthly Rates

Plan A -- $92 (UnitedHealthcare) and $97 (New Era Life)

Plan B -- $120 (Aetna) and $128 (United States Fire)

Plan C -- $122 (New Era Life) and $124 (UnitedHealthcare)

Plan D -- $114 (UnitedHealthcare) and $139 (Central States)

Plan F -- $113 (Cigna) and $115 (S USA Life)

Plan HDF -- $33 (New Era Life) and $35 (Great Southern Life)

Plan G -- $98 (UnitedHealthcare) and $101 (Elips Life)

Plan HDG -- $32 (New Era Life) and $35 (Medico)

Plan K -- $50 (United States Fire) and $51 (UnitedHealthcare)

Plan L -- $63 (United States Fire) and $85 (UnitedHealthcare)

Plan N -- $72 (Cigna) and $77 (S USA Life)

Lincoln, Nebraska (Lancaster County) Medigap Monthly Rates

Plan A -- $101 (National Health) and $104 (UnitedHealthcare)

Plan B -- $146 (United States Fire) and $149 (Continental Life)

Plan C -- $153 (Philadelphia American) and $164 (Central States)

Plan D -- $119 (Philadelphia American) and $257 (United American)

Plan F -- $127 (National Health) and $128 (SBLI USA Life)

Plan HDF -- $37 (United American) and $40 (Great Southern Life)

Plan G -- $106 (National Health) and $113 (Medico)

Plan L -- $104 (UnitedHealthcare) and $134 (Humana)

Plan N -- $80 (National Health) and $86 (SBLI USA Life)

Los Angeles, California (LA County) Medigap Monthly Rates

Plan A -- $101 (National Health) and $104 (UnitedHealthcare)

Plan B -- $146 (United States Fire) and $149 (Continental Health)

Plan C -- $153 (Philadelphia American) and $164 (Central States)

Plan D -- $257 (United American) and $301 (Sentinel Security)

Plan F -- $127 (National Health) and $128 (SBLI USA Life)

Plan HDF -- $37 (United American) and $40 (Great Southern Life)

Plan G -- $142 (United World Life) and $142 (Anthem BC)

Plan K -- $57 (United States Fire) and $71 (UnitedHealthcare)

Plan L -- $72 (United States Fire) and $104 (UnitedHealthcare)

Plan N -- $80 (National Health) and $86 (SBLI USA Life)

Which States Have The Most And Least Expensive Health Insurance Rates? (Under Age 65)

Although prices change each year in all parts of the US, typically, specific areas tend to always be among the most expensive, or most affordable states to buy healthcare coverage. Below, we have listed our 2023/2024 results (in alphabetical order). The research was based on Marketplace premiums in several random cities in each state. Of course, rates will significantly vary, depending on your zip code, age, and income (with a federal subsidy).

Cheapest States And Average Monthly Cost Of Coverage

New Hampshire -- $342

New Mexico -- $351

Maryland -- $352

Colorado -- $372

Minnesota -- $374

Washington -- $391

North Dakota -- $405

Michigan -- $407

Maine -- $412

$415 -- Rhode Island

Most Expensive States And Average Monthly Cost Of Coverage

West Virginia -- $714

New York -- $716

Wyoming -- $674

Nebraska -- $633

Louisiana -- $628

Vermont -- $626

Massachusetts -- $600

California -- $598

Nevada -- $570

Alaska -- $568

The Hidden Silver Plan Gem

The Silver plan is one of four "Metal" tier policies available when you choose coverage. The others are Platinum, Gold and Bronze. A special "Catastrophic" option is available for persons under age 30. Any company that wants to participate in the Marketplace must offer consumers at least one Silver and Gold plan. Many carriers choose not to offer Platinum and Catastrophic options since they are the least popular. Also, when comparing options, often a Bronze-tier plan offers more benefits at a lower premium than a catastrophic plan.

Catastrophic policies are generally more expensive than Bronze plans and are rarely purchased. You also must be under age 30 to qualify (or prove "financial hardship"). However, the biggest deterrent from buying a catastrophic plan is that they are not eligible for federal subsidies. With most households, this single factor makes them very unattractive. And although preventative benefits are fully covered, most other expenses must meet a large deductible. Non-preventive office visits, however, are partially covered, since three visits per year (per person) are provided with just a copay.

From an actuarial standpoint, Silver plans are expected to pay about 70% of your anticipated medical expenses. The remaining 30% consists of the deductible, copays, and coinsurance. Often the deductible is in the $3,500-$5,500 range, but maximum family out-of-pocket expenses can be as much as $18,900 for a family. A single plan will have out-of-pocket limits half the amount of a family policy ($9,450). It is not unusual for deductible amounts to widely vary, although maximum out-of-pocket expense amounts are often similar. Maximum allowed deductibles generally increase each year, and significantly higher options may be offered again in 2025.

The Joy Of A Silver-Tier Plan

But here's the "hidden gem." The Silver option is the only Metal policy with "cost-sharing." If your household income is below 250% of the Federal Poverty Level, than you can drastically reduce the deductible and copays. Here's an example:

Consider an Indianapolis family of two adults (both age 48). The household income is $32,000 and pre-existing conditions previously prevented an applicant from obtaining conventional coverage. Also, they can not afford to pay a large deductible (such as $5,000) if they have a major claim.

The Ambetter Balanced Care 12 plan usually costs approximately $1,100 per month with a $6,500 deductible and $8,150 out-of-pocket expenses (per person). But instead, the subsidy "cost sharing" reduces the deductible to $950 and the premium to only $159 per month. That's a savings of more than $10,000 per year and the deductible drops by about 95%. Maximum out-of-pocket expenses also drop to only $1,850. The pcp office visit copay is $10 and the specialist copay is only $30.

If the income increases to $40,000, the subsidy is more than $800 per month, and the deductible also reduces. The CareSource Marketplace Low Premium Silver 2 plan also provides substantial savings with a low deductible and small office visit copays.

Ambetter offers very similar options in most of the other states where they participate. NOTE: In several states, including California and Arizona, the reductions of deductibles and out-of-pocket expenses will not be as significant. Our website makes it possible to health insurance plans from multiple companies. Carriers such as Cigna and Kaiser are not available in all states.

Bronze Metal Plan Options

Bronze Exchange policies are often the least expensive policy you can purchase, unless your low income can qualify for a "catastrophic" plan. Why are Bronze options the cheapest? Because, from an actuarial standpoint, it is calculated that you will have to pay approximately 40% of your medical expenses out of your own pocket. Thus, as opposed to the 30% (Silver), 20% (Gold) or 10% (Platinum) contracts, your risk is higher. And the deductibles are often applied to office visits and prescriptions, and not just major medical events. ER and Urgent Care out-of-pocket expenses are also higher than most other plans, and may require a deductible to be met.

But what if you had no serious medical issues and you were unlikely to incur enough expenses to meet a smaller deductible such as $1,500 or $2,500. Of course, you would select a higher deductible (perhaps $3,500, $5,000 or as high as $9,100), and pocket the savings. If a serious medical condition developed, each Open Enrollment you can choose to switch to a different policy, that may be more cost-effective in covering your new expenses. You could also customize a plan to cover specific medications you take or ongoing expensive therapy.

That's the concept of the Bronze Metal plans. Your worst-case scenario is $9,100 of medical expenses (that's the law per individual) that you are unlikely to incur. Therefore, why pay for benefits that you probably will not utilize? And since this type of plan is likely thousands of dollars less in premiums (family plans), you can pocket the difference as a reward for your good health. Of course, each year, it's very important to review your projected medical expenses and household income for the following year. If a serious medical condition is now present, changing to a higher-tier plan may be the best option.

Important Note: Bronze-tier plans often require that you meet a deductible before utilizing two very expensive benefits -- Specialist office visits and non-generic or brand-name prescriptions. Thus, if you anticipate needing either coverage before the next Open Enrollment, paying a bit more for a Silver-tier policy may save you money. Often, if you take multiple brand drugs with no generic substitute, purchasing a Silver-tier policy may be more cost-effective. Also, a few higher-priced Bronze plans may cover specialist visits with a copay. But the copay could be as high as $120 (Highmark My Connect Blue EPO 6500B).

Medicaid Expansion

In many states, the expansion of Medicaid has created unique opportunities for low-income families to qualify for free healthcare benefits. The threshold for determining who qualifies (and who is denied) has changed, and Medicaid enrollments have increased in every state. Actual expansion and liberalization of eligibility guidelines have taken place in about 36 states. The states that have not expanded Medicaid are Wyoming, South Dakota, Texas, Oklahoma, Utah, Tennessee, Mississippi, Alabama, Georgia, South Carolina, North Carolina, Florida, and Missouri.

The states that have not expanded (yet) would like to transfer the matching (Medicaid) funds so their state residents can purchase coverage through the Exchanges. It's not a bad idea, assuming the benefits provided equal or exceed coverage that would have normally been furnished. And since more doctors, specialists and hospitals would be made available, network coverage would increase.

Often, individuals or couples in their 50s and 60s will surprisingly qualify. It's also possible that in any year, your income may change, and you will be able to buy subsidized coverage through Exchanges. Since it's a fluid process, it's important to review choices before Open Enrollment each year. Losing employment, or adding dependents without an increase in household income, can quickly result in loss of subsidy-eligibility, and immediate eligibility of Medicaid.

Conversely, sudden increases in household income can lead to loss of Medicaid-eligibility, or an unexpected increase in taxable income. This can result from job changes, job promotions, or the addition of a second spousal income. If the household income is just above the maximum allowed amount, the federal subsidy will be substantial, and policy rates should remain very affordable. The addition or removal of dependents in the household can impact subsidy, CHIP, or Medicaid eligibility. Moving to a different service area can also impact plan choices and subsidy amounts.

Medicaid expansion often provides a significant economic impact to states. The increased revenue expands and creates jobs, especially in the healthcare industry. Previously unemployed workers can also find lower-paying jobs that don't provide medical benefits, but do provide badly-needed income for their household. When the economy is robust, higher-paying jobs with better benefits continue to be offered.

With free preventive benefits provided, a larger portion of the population is healthier, assuming they take advantage of the free coverage. Future legislation may require completion of annual physicals and OBGYN visits, to take advantage of federal tax credits. It's also possible that online accounts (similar to HSAs) will be created to encourage completion of preventative visits and recommended testing and procedures. Carriers may provide wellness incentives, consisting of small deposits ($100-$500 per year) to encourage and promote good health.

Short-Term Options

Temporary medical plans are the least expensive type of coverage offered by the large reputable companies. They are typically used when there is a short-term gap in benefits. Often, these gaps are a result of job loss, graduating college and waiting for employment to begin, seasonal layoff from work, job termination, or waiting for Medicare coverage to start. Also, many uninsured persons will simply wait until the next Open Enrollment before purchasing coverage. This concept, of course, can have disastrous consequences if you develop a serious medical condition before you enroll.

Although extremely cheap, these policies are not Affordable Care Act-compliant, and therefore do not include 10 required "essential health benefits." You can usually keep your policy for up to three months, but the benefits-paid cap is often between $250,000 and $2 million, and a deductible applies to all claims. Pre-existing conditions are not covered and are generally permanently excluded. Young adults often use temporary coverage (details here), because of the low premiums, especially if they missed the Open Enrollment deadline of December 15th.

But the rates are very affordable! Listed below are monthly rates for a UnitedHealthcare short-term (Value Select A and Plus Select A option) policy for a 45 year-old male living in Columbus, Ohio. Prices are predominately based on age, smoking status, and zip code. Several other companies offer temporary plans that include additional riders that can be easily added. NOTE: Of course, rates will vary, depending where you live. For example, rates in Chicago, Detroit, New Jersey, California, and most other areas, will be higher than Columbus prices.

$100 -- $5,000 Deductible

$124 -- $2,500 Deductible

$149 -- $1,000 Deductible

Short-term policies are often approved within 12-24 hours of the application submission, and are quickly underwritten. Quite simply, there are about six medical questions (along with a few administrative questions). If you are able to answer all questions "no," you will be approved. Applicants that take medications for high blood pressure or high cholesterol, may be subject to additional underwriting and could possibly be declined. Other major companies that offer competitive rates besides UnitedHealthcare, include National General, Anthem Blue Cross, Companion Life, IHC Group, and HCC Life.

The cheapest Health Insurance Exchange rates will save you hundreds, or perhaps thousands of dollars, compared to more expensive plans you may currently have. Get your free quotes, compare quality plans and save! We specialize in providing consumers with the most affordable plan options in their area, and customizing coverage to best match your budget and any pre-existing condition. Enroll in less than 20 minutes with no waiting period for submitting medical claims once the policy is effective.

Additional Information From The Past

Open Enrollment begins November 1 and ends December 15th. The 45-day window provides consumers some additional time to shop and purchase coverage. Bad weather and conflicting dates with Medicare Supplement sign-up were two of the main reasons for the change.

Special Enrollment Period (SEP) situations will continue throughout the entire year for persons that lose coverage through an employer, or qualify for one of several available exemptions. In the event of a birth of a child after the OE period, the newborn is eligible for an SEP, but not the parents. Also, when a child reaches age 26, although they are eligible for an SEP, the parents must retain their original policy.

To qualify, you can not presently be enrolled in an approved Exchange or non-Exchange plan, and must verify that you filed your federal tax return and paid all applicable penalties or fees. Consumers who live in a state with a federally-facilitated Marketplace can take advantage of this offer.

The cheapest health insurance rates just got a little more expensive! Well, actually, prices are going up as most companies have requested premium increases for next year. It's now up to each state's DOI to approve in full, partially approve, or deny these requests. Typically, most of the increases are granted, assuming the carrier can prove they suffered an underwriting loss.

Open Enrollment has begun and rates in most states have increased. Alaska's prices have risen the most,an average of more than 50% for all plans. Conversely, Indiana premiums have reduced for most carriers. Some have slashed rates as much as 10%-15%. Aetna and UnitedHealthcare are now offering plans in more states while many CO-OPs have ceased operations. Assurant, a large health insurer has also stopped writing individual business.